Overview of market

Despite challenging conditions in the Real Estate M&A market, Lockton has advised on a steady flow of deals in H1 2023 and we are cautiously optimistic for the next 6-12 months.

Corporate real estate transactions have been hit particularly hard by the economic slowdown, however there are certainly pockets of activity. While real estate investment levels have definitely slowed as interest rate rises and inflation impact on debt serviceability and profit margins, the reduction in supply of quality real estate assets has driven yield upwards in certain sub-sectors. As a result, in some cases we are seeing seller/buyer valuation expectations start to align, in particular for those buyers using little-to-no leverage.

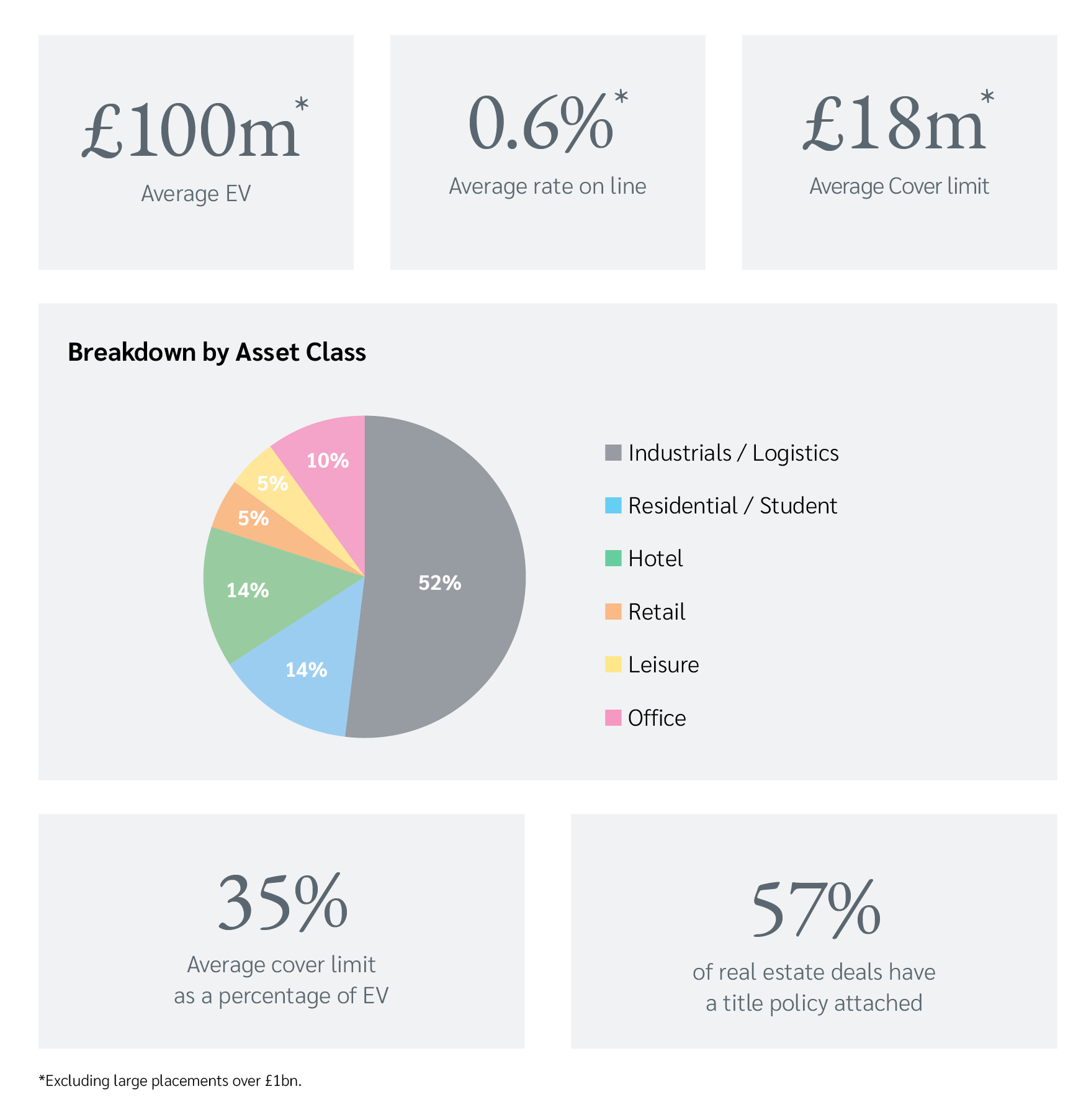

We note that the industrials and logistics sub-sector remains strong, with data centres, warehousing and cold storage being the primary focus. However, we are also very pleased to have worked on some landmark student accommodation, co-living and hotel portfolio transactions. While retail activity has been pretty sluggish, it is encouraging to see traction in the office space.

Real Estate Transactional Risk Insurance – what Lockton is seeing

Despite a hardening general insurance market, the M&A market has softened as insurers compete for the reduced number of deals on offer. As a result, the average rate on line for real estate warranty and indemnity (W&I) premium is currently at a record low. For single asset deals this has dropped as low as c. 0.45% (for up to 20/30% EV limits), while for more operational real estate deals this has dropped to c. 0.8%.

Given the state of the debt markets currently, it is no surprise that we are seeing more seller-buyer flips. After all, the cost of M&A insurance is substantially cheaper than reserving or obtaining/extending facilities through inflated debt pricing. We are also seeing many more open-market deals where the cost of premium is now shared between buyer and seller, rather than the buyer entirely footing the bill in a bull market.

Insurers are keen to distinguish themselves by demonstrating increased flexibility towards coverage and by offering additional enhancements for less (and in certain cases, no additional premium).

Key metrics from the deals that we have placed in H1 2023 are set out below:

Looking Ahead

It is a given that as and when market conditions improve, huge amounts of dry powder is just waiting to be deployed on real estate assets. While appetite for the use of Real Estate Transactional Risk Insurance remains strong for corporate real estate transactions, we expect volume to increase in conjunction with the M&A market as a whole.

Even though M&A activity has been quieter, we have been actively engaging and listening to our clients, advisers and insurers. Unsurprisingly, insureds are increasingly focused on obtaining cover tailored specifically to their commercial needs. On the other hand, insurers, capacity providers and reinsurers equally want (and desperately need) to see more premium rating adequacy for the capital they deploy.

Transactional risk insurance is an increasingly key component of any corporate real estate transaction, but we are conscious that the product offering needs to continue to innovate and evolve. The solution is clear: there needs to be increased relevance for clients, more risk transfer innovation and more clarity.

Not every deal is the same, we get that. However, we have been busy working on a number of key product enhancements that can now be offered when insuring corporate real estate transactions. This increased competition in the real estate M&A insurance market clearly benefits insureds; there are now very few major deal breakers when it comes to what risks can be covered. Although these product enhancements continue to evolve, we hope you find the below selection helpful.

Product Development | Community |

|---|---|

Synthetic Cover | Synthetic cover was originally used to cover deals that have some form of distressed element or valuation

concern, but we are now increasingly seeing this cover used on non-distressed deals. In particular, where the seller might have a strong negotiating position (especially if they are having to accept a reduced purchase price in a more buyer-friendly market), they may decide to only provide limited warranties. In which case, certain |

Interim (New) Breach cover | New Breach Cover allows the insured to claim for loss where there is a breach of the signing warranties which occurs in the period post-signing/pre-closing AND the breach is discovered/disclosed pre-closing (which is typically excluded by W&I insurance). New Breach Cover is generally only applicable for non-operational real estate deals where the interim period between signing/closing is three months or less. |

RE Development cover | Cover for development deals, where the development project is due to take place between signing and closing. More appropriate for up to a two-year interim period, providing cover for short-form signing warranties (pre-development) and more extensive closing warranties (post development). |

State & Condition of Assets cover | Cover for state and condition of assets (subject to wear and tear, depreciation and betterment etc), either subject to knowledge qualifiers or full cover, depending on level of diligence carried out and underlying property insurance in place. |

Insured's option for payment of loss basis | Extension of indemnity measure of loss enhancement, so as to give the insured the option to elect for loss to be paid on either an indemnity or diminution in value (i.e. contractual) basis, either at policy inception or upon notification of a breach under the policy. |

Tax Covenant given at signing | Tax Covenant to be given synthetically at signing (not closing), so that the insured can claim for a breach that it becomes aware of in the period immediately prior to signing). In other words, this provides cover for any pre-signing tax liabilities suffered by the Target under the Tax Covenant, side by side with the Tax Warranties. |

Affirmative Tax cover | Affirmative tax cover for specific tax risks that are identified in the tax DD report (and which would ordinarily be excluded from W&I cover), so long as the Buyer and its advisers can demonstrate that, having fully diligenced, analysed and quantified such risk(s), the risk profile is low. |

Environmental Risk cover | Additional environmental insurance cover for historic known and unknown environmental risks (which would usually be excluded under a W&I policy), where environmental DD reports identify land legacy issues and/or there is insufficient (or no) existing underlying environmental impairment liability insurance in place. |

Certificate of Title top-up cover | Bespoke legal indemnity cover, where the limit of liability provided by lawyers to their clients in respect of Certificates of Title is often capped by their professional indemnity (PI) insurance. This enhancement therefore provides top-up insurance cover in excess of the law firm’s PI liability cap to full EV. |

RE Fund Wrappers | End of life insurance for RE Funds, whereby the remaining warranty periods for each of their M&A exits are insured, enabling the Fund to cancel reserves, liquidate assets and finalise returns to its investors/LPs. |

RE Funds - GP/LP Secondaries | Transactional risk insurance for GP-led transactions/restructurings, fund-of-funds interest transfers and LP interest transfers. |

US Hybrid cover | Various US style enhancements to consider (particularly where the insured is US based), such as (a) removal of disclosure of both data room and DD reports, (b) full seller knowledge scrape, (c) no written responses to UWQs and (d) no warranty spreadsheet. |

We continue to innovate, and more product enhancements will undoubtedly follow (especially in relation to specific tax and contingent legal risks). When the market bounce hits, whether you’re on the sell side or the buy side, rest assured that Lockton’s Real Estate Transactional Risks team can legitimately protect your interests, mitigate your risks and help maximise your value creation.

Meet our Team

Lockton’s Transactional Risk real estate team has over 50 years of combined experience (as brokers, underwriters and corporate lawyers) working on corporate real estate transactions across the UK, Europe, APAC and MENA. We are proud to have such strength and depth in our team.

Our client base includes institutional real estate investors, investment managers, private equity funds, sovereign wealth funds, pension funds, joint ventures and developers. We have worked on transactions across virtually all real estate asset classes, including office, logistics, healthcare, retail, leisure/hospitality, student housing and residential properties, as part of single asset deals, portfolios and development projects. We have a wealth of experience working together with our clients, their advisers and M&A insurers, in advising how best to structure and place innovative and bespoke transactional risk insurance solutions so as to mitigate complex risk, facilitate real estate deal execution and enhance investor returns.

We also work closely with our Global Real Estate and Construction (GREAC) team, to uniquely provide our clients with a full complement of real estate transactional risk insurance products in one offering.

For more information on this market update, or how any of these product innovations work in practice or are priced, or if there is anything that our team can assist with, please get in touch:

Somers Brewin

Vice President and Solicitor

E: somers.brewin@lockton.com

M: +44 (0)7920 106 875

Rachel Williamson

Vice President

E: rachel.williamson@lockton.com

M: +44 (0)7741 383 587