Skip to main content

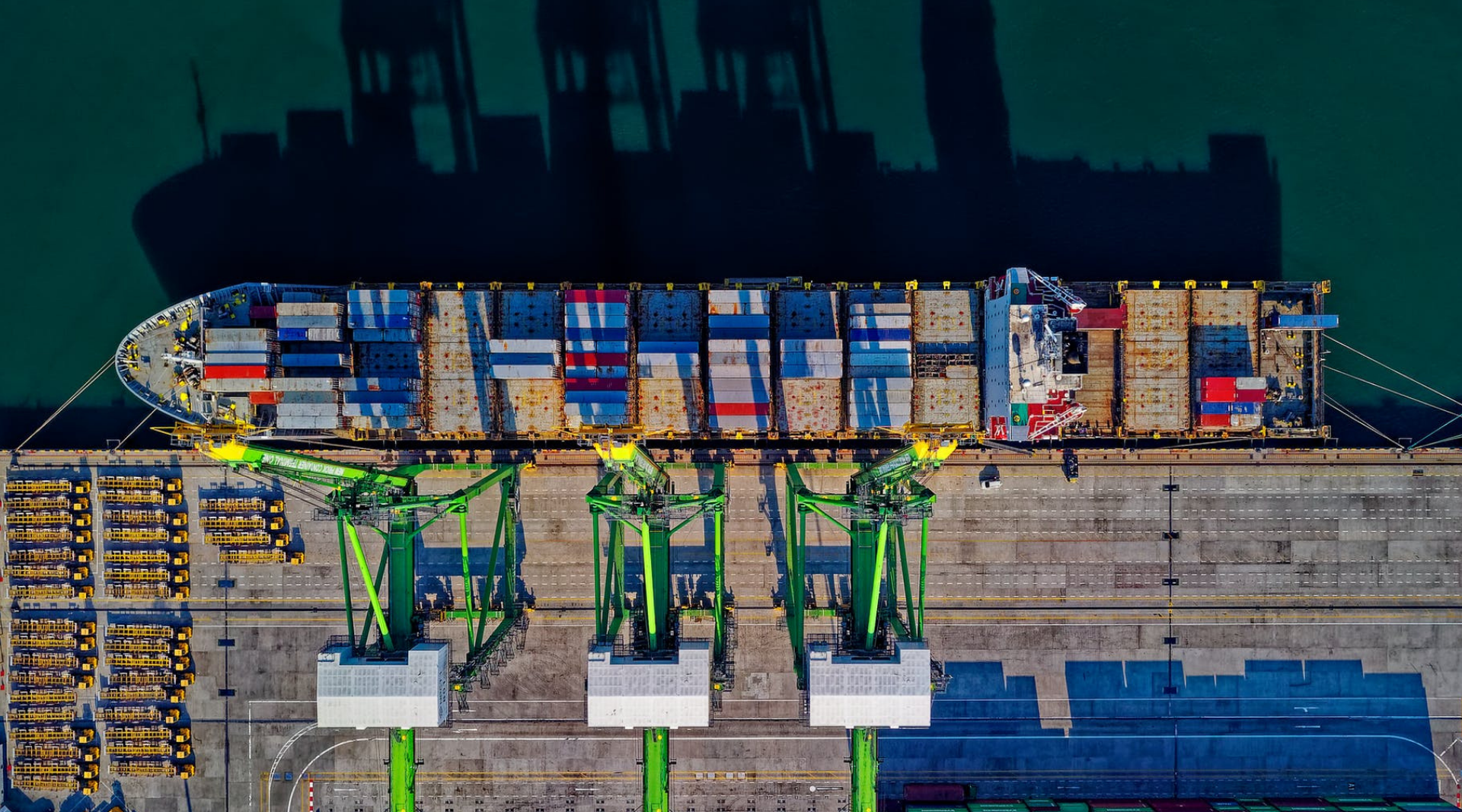

Lockton is the world’s largest independent insurance brokerage. From airlines to Aston Martins, from food service to financial services; from technology to transport: we protect your business so you can focus on building it

1 / 5

Our Products and Services

We’re ready to help with all your risk management and insurance needs

Explore

News and Insights

Cyber Insurance Market Update: Rates decline despite rising claims

articleKey takeaways: Cyber incidents on the up – Incidents surged to unprecedented levels in 2025, yet premiums fell by an average of 11% and coverage broadened. This marks a rare divergence between underlying risk and insurance pricing. Increased capacity drives ra ...

Uncommonly Independent

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

See our storyWith a global footprint of 150+ offices and partner offices, find one near you.

Find an officeWe're here to help

We bring creative thinking and an entrepreneurial spirit to the insurance business and are uniquely positioned to help you succeed.

Talk to our teamYou're viewing the preview environment, which displays the latest draft of all content.