Precious metals now play a critical role in several emerging industries, providing a core component in everything from AI-powered microchips to booming clean energy infrastructure. It’s therefore no surprise the global precious metals market is projected to grow from USD 323.71 billion in 2024 to USD 501.09 billion by 2032, according to a study by Fortune Business Insights (opens a new window).

These growth opportunities have attracted investors. Despite falling prices for most critical minerals throughout 2023, GlobalData’s Mining M&A report (opens a new window) noted that total mining M&A value exceeded $121bn in 2023 – a 75% increase compared to the previous year. Warranty & Indemnity (W&I) insurance (opens a new window) products in the UK, and Reps and Warranties Insurance (RWI) (opens a new window) products in the US, regularly assist in M&A processes, but they are particularly useful tool in the mining sector.

Are mining transactions insurable?

This is a frequently asked question, but the short answer is yes.

The biggest hurdle to obtaining W&I or RWI for a mining transaction rarely relates to the activity of mining itself. Insurers are open to covering various types of mining projects, including surface, placer, in-situ and underground. In respect of what is being mined, projects involving the extraction of coal or other carbon fuels is generally not coverable, whereas insurers are generally open to insure the mining of precious metals and minerals, such as aluminium, copper, gold, and silver.

Instead, any restriction is usually related to the jurisdiction of the target. However insurer appetite and experience across a variety of jurisdictions is increasing.

Facilitating deals with W&I or RWI

Like all transactions utilising W&I and RWI, the parties will benefit from the various deal facilitation tools they bring.

Sellers will exit with a $1 cap on their liability, with no need for escrow or any form of retained consideration.

Buyers have the benefit of warranties being backed by an AAA-rated insurer, the ability to claim against a specific M&A policy rather than litigate against a business associate, and have their claims managed by their broker’s specialist claims team. Feedback based on hundreds of transactions also evidences the reduction in negotiation time as the “heat” is taken out of the warranty negotiation process, resulting in protection from price-chips.

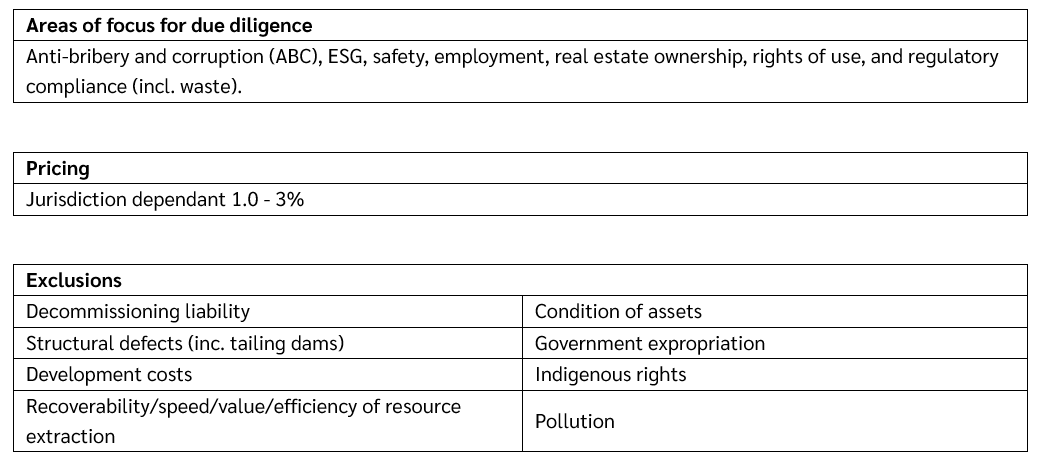

W&I/RWI in detail:

As M&A in mining continues to grow at pace, W&I and RWI products provide clients with valuable protection from losses arising under the transaction agreement. But they can also serve as a key deal-facilitation tool in the negotiation process of a corporate merger or acquisition.

For more information, please visit the Lockton Mining page (opens a new window), or contact your Lockton representative.