Mining companies are slashing greenhouse gas emissions and working closely with a variety of stakeholders to create a sustainable value chain and reduce their exposure to environmental, social and governance (ESG)-related risks.

Investors, clients, regulators and lenders are increasing the pressure on mining companies to align their operations with ESG expectations.

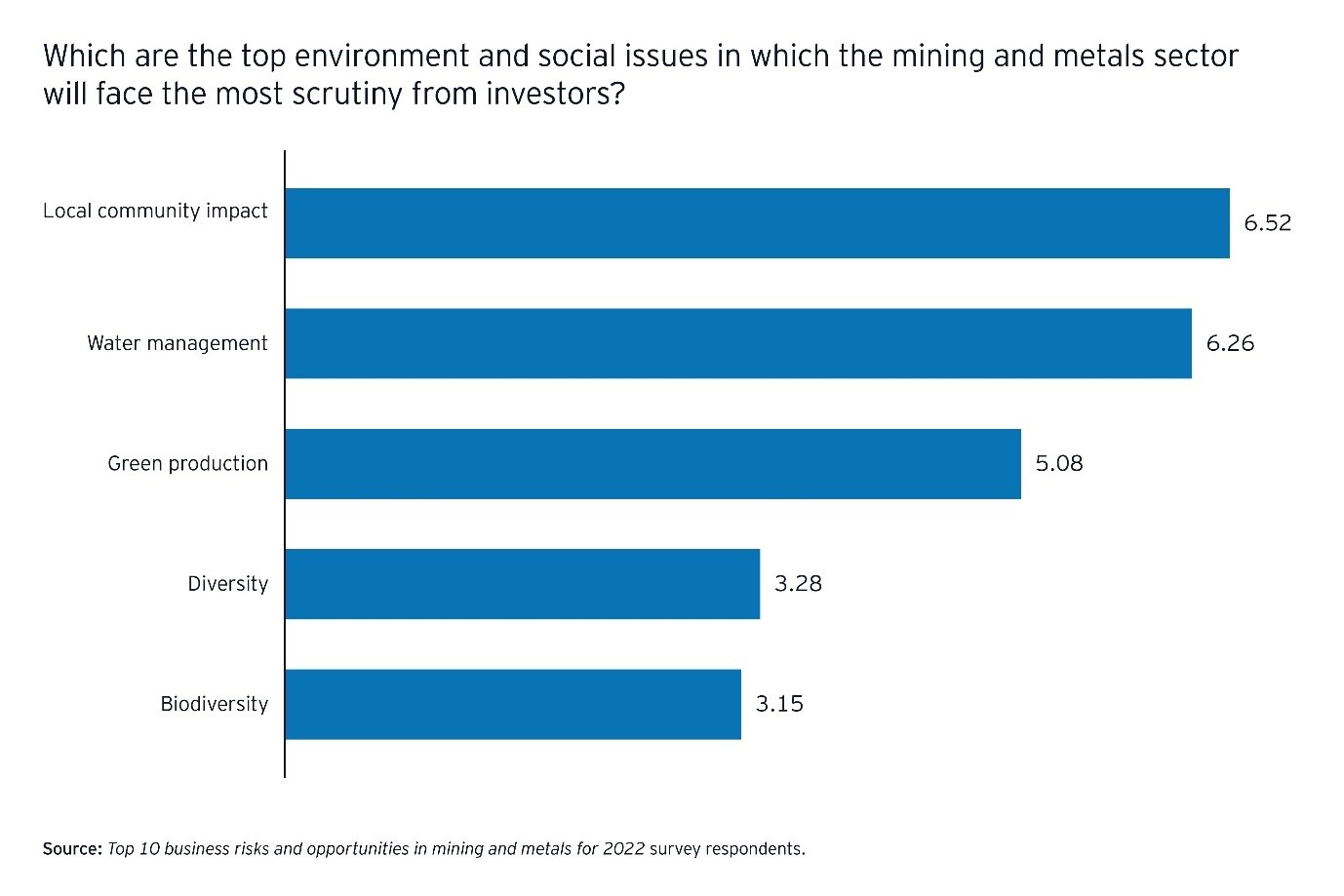

Environment and social issues ranked as the number one risk the mining and metals sector is facing in EY’s most recent “Top 10 business risks and opportunities for mining and metals 2022 (opens a new window)” survey (up four positions from 2021). Decarbonisation came second (up four positions from 2021) followed by license to operate (LTO), which had held the top position over the past three years. The survey also found that companies are under increasing pressure to take more responsibility for their impact on communities and go beyond their regulatory obligations.

This is the first time that mining and metals companies rank environment and social issues as their number one risk.

The climate change response

To comply with ESG requirements and expectations, mining companies are developing decarbonisation strategies that require scenario modelling and a review of available funding, technology and assets.

In October, Rio Tinto (Rio) announced a plan (opens a new window) to reduce carbon emissions by 50% (on 2018 levels) by 2030, more than tripling its previous target. Rio is planning to replace diesel trucks with battery technologies or hydrogen. The miner is also working towards full electrification of autonomous trains that run on its 1,700-kilometre rail network. To find the best solutions to reach its goal, Rio is partnering with suppliers, governments and customers. Rio also aims to reduce shipping emissions by 40 per cent by 2030 and will require the shippers of its products and suppliers of goods and services to achieve net zero by 2050.

Andrew Forrest has recently unveiled plans (opens a new window) to build a green energy production centre and initially, the focus will be on hydrogen electrolysers, followed by wind turbine equipment, solar photovoltaic (PV) cells, and electrical cabling. Forrest has declared that he wants to build more than 100GW of renewable hydrogen capacity (opens a new window) by 2030. The green energy is initially set to power mining operations in Queensland. As part of his sustainability push, Forrest is also investing in a grid-connected battery system and a green mining fleet powered by hydrogen and battery electric energy solutions.

Oz Minerals wants its next mining project, West Musgrave in Western Australia, to be carbon neutral (opens a new window) and the plan is to power the copper-nickel project completely via a renewable on-site power plant. The mining fleet is also set to be emission free. The goal is to create a zero-emissions value chain producing mining goods that can be marketed as clean, green products for consumers.

The social aspect

Licenses to operate are changing fast, driven by shifting expectations around mining’s contribution to communities, economies, protection of heritage sites and engagement with indigenous and First Nations people.

Over 40% of EY’s survey respondents say that community engagement will be the focus of investor scrutiny of mining and metals in 2022.

Mining companies have traditionally collaborated with local government departments and social partners to increase the acceptance of large mining projects within the community. Such projects may help promote healthcare services through infrastructure, development, capacity building and programme support. They may also empower communities and help creating jobs through education and youth workforce development programmes. Through enterprise programmes including business mentorship and access to capital, mining companies can also support entrepreneurship and help create a more economically resilient society. Supporting environmental projects may increasingly gain traction as the consequences of climate change starts impacting communities. Keeping a continuous communication flow and engagement with the local community is essential to understand the changing needs of societies and help address potential issues.

The risk of inaction

While licences to operate lost the top spot risk for the mining and metals sector it held for the past three years in EY’s survey, it is still seen as a top three risk.

Licences are increasingly linked to a company’s ability to access resources, capital and debt. However, regulators are pushing banks, insurers and asset managers to reduce their greenhouse gas exposure. The European Central Bank has recently reminded lenders (opens a new window) that they have to produce a plan that shows that they will change their business strategies to account for the climate crisis. Consequently it will be necessary that mining companies demonstrate their achievements in a sustainability push to remain appealing for investors and lenders and retain access to attractively priced capital.

Access to capital remains challenging for mining and metals companies, with investors deterred by risks associated with ESG, LTO, community issues and volatility, according to EY.

Lawsuits from stakeholders are another potential driver and accelerator of change. ESG litigation has the potential to profoundly impact a company and its ongoing viability, Latham & Watkin, a law firm, noted in an ESG Litigation Roadmap update (opens a new window). ESG litigation can impact a business’ purpose, reputation, corporate values, approach to risk management, and relationships with investors, suppliers, customers, employees, and other stakeholders.

While ESG litigation so far has mostly focused on climate change litigation or catastrophic environmental events, legal challenges may target diversity issues and social conditions at supply-chain partners. These claims can be directed at the level of parent companies and/or at individual directors themselves, requiring special attention to oversight/governance and data and systems to provide timely information across operational areas, business models, and supply chains. ESG-related disclosures will likely trigger claims based on public reporting (or the absence of public reporting) according to the document.

The role of insurers

Insurers are increasingly looking to only partner with organisations in the mining sector with best-in-class ESG scores. This is in addition to the traditional insurable risk profiles of these organisations. This thinking is driven predominantly by shareholder expectations and insurers increasing obligations to be good corporate citizens in the eyes of the public. It is now more important than ever that mining projects approach their insurance/risk transfer partners in the same manner as they would communicate with project financiers/investors as they are deploying their capital in a similar manner and are increasingly looking for “green” projects to invest in.

According to EY, “miners that can demonstrate their contribution to a sustainable future will have a competitive advantage”. This statement is also extremely relevant to the insurance placement for new projects with insureds needing to be placed at the front of the queue when insurers are looking to deploy their capital for insurance of projects, of which there are many in the pipeline.

Insurers do see value in using ESG factors to not only identify and measure risks, but to find new business opportunities, according to a recent report by A.M. Best (opens a new window), a credit rating agency that focuses on the insurance industry.

For further information, please contact:

Stephen Kerridge , National Manager Resources Lockton Australia

T: +61 8 9217 0816

E: Stephen.Kerridge@lockton.com